Digital Printing

Published

15 years agoon

Early in 2009 someone asked me, “How much overcapacity do we see in the US right now?” He asked this leading question in the context of wide-format printing equipment. His point must have been that so much equipment is installed, and it is so productive, that we must be over capacity—especially in light of the economic downturn. The question got me thinking. We’re seeing news of layoffs all over corporate America, we are in an era when my three year old knows what downsizing is, and people are as productive as ever.

Maybe he’s right. Maybe we’re over capacity as an industry, but I don’t see that as a condition that will change. I think it’s a characteristic of the printing industry as a whole. After all, shop owners want to be prepared for the busiest times. Most businesses have their ebbs and flows, but the extremes are highly disruptive. The extreme ebbs cause layoffs and ruin companies; the extreme flows create jobs and make people invest in new and more productive equipment.

I really can’t say whether the market for wide-format digital graphics is any more prone to run at low capacity than any other segment of the market, but I do understand why it is the way it is. In a recent InfoTrends study, we asked more than 300 corporate print buyers, all who regularly buy wide-format digital printing, about their typical turnaround requirements for wide-format graphics. The answer to this question helps us understand why the need exists to invest in faster and faster digital equipment for the production of wide-format graphics. Our data show that these buyers need 20% of the graphics they purchase to be printed on the same day the place the orders and that 70% of orders must be fulfilled within two business days.

The need for speed is likely to accelerate. In the same study we asked these corporate print buyers why they chose certain print-service providers. Their responses indicate that the top three considerations are price, quality, and turnaround time. These responses far outweighed the other decision-making points: knowledgeable staff, convenient location, customer service, range of products/services, and availability of expert design help. This makes sense, right? Even if a printer can meet the price you need and you trust they will do a good job, what good is that if they can’t meet the deadline?

The greater need for speed, quality, and lowest available price are the primary developments that bring us to this point, which I call the dawn of automation in the wide-format market. We’re seeing more and more manufacturers develop systems that have new automation features that increase productivity while reducing operator intervention. Some examples:

Onset In 2007, Inca Digital launched the Onset, which has either semi- or fully-automatic media load/unload capability. Also launched at SGIA ’08, Inca Digital launched the lower-end Onset S20 with “semi-automated” feeding. The Onset has a ra-ted speed of 6,458 square feet per hour while the lower-end S20 has a rated speed of 2,690 square feet per hour.

DS-series EFI launched the DS-series at drupa in the summer of 2008. The first printer in the DS-series, the DS8300, has an optional automated material handling system which the company promises improves productivity and dramatically reduces loading and unloading times. The DS8300 has a rated speed of 6,000 square feet per hour.

FB-7500 Launched at SGIA ’08, the HP-Scitex FB-7500 features what the company calls three-quarters automated loading, which the company indicated reduced idle time between sheets by 85 percent. The maximum rated speed of the FB7500 is 5,380 square feet per hour.

HAL In the first quarter of 2009 Gandinnovations introduced its Highly Automated Loading (HAL) system. The HAL system is supposed to be able to load and unload the media for two Gandi flatbed printing systems. Gandi’s literature on the HAL system indicates that it could keep two Gandi flatbeds running on a 24 x 7 basis.

All of these are high-speed, wide-format, UV inkjet printers that sell for more than $1 million. To be sure, many companies—particularly RIP companies—offer tools that automate production at the front end. Color calibration, color management, tiling, previews—all of these are designed to minimize re-works or maximize each job, thereby improving productivity. In no way do I mean to slight any other manufacturers or equipment developers by failing to mention any other features, but I show these in order to compare these high-end printing systems and watch as their rated speeds drive upward partly based on their new level of hardware automation.

I think we’re at the dawn of automation in the wide-format-graphics business. Why? Because of the available opportunities for increasing the level of production through automation even for much lower-end types of equipment and processes—especially on the finishing side, which is often a bottleneck in the production workflow. Sometimes the bottleneck stems from the belief that it’s necessary to wait a certain period of time for graphics to dry before finishing. But sometimes finishing is a bottleneck because the people who do it most effectively only work during certain hours or days.

Before I am accused of leading a charge to eliminate jobs, I should note that is not what I am suggesting. People are still required to operate and repair the printing and finishing equipment, but the time between sheets or between print swaths could be reduced through greater use of automation tools.

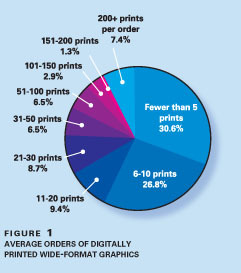

These developments are very im-portant as an obvious response to customer demand for quick turnarounds. But yet another finding from this new study explains the continued demand for digital printing equipment. When asked about average order size, more than half of the respondents who buy wide-format graphics reported that they buy fewer than 10 prints at a time, and about 82% buy in quantities less than 100. So in addition to short turnaround times, we have small order quantities (Figure 1).

What do the numbers mean?

I think these research findings point to a trend in which purchasing patterns for shorter print runs are leaning toward digital. So in a sense, yes, if you consider that there are idle, wide-format screen presses while smaller, slower digital printers are producing a growing share of wide-format graphics, yes there is an underused capacity that is probably noteworthy. There also should be less waste in terms of screens and chemicals used for this short-run work, as well as the wide-format graphics printed and then inventoried, the graphics that are printed and shipped and then discarded, and of course the transportation costs for all of those materials.

The increase in focus on sustainability also is one of the selection criteria that print buyers use when they consider which print-service provider to choose. More than 40% of the print buyers indicated that their wide-format-graphics purchases reflect a preference for green printing, such as prints made on recyclable materials or using environmentally safer inks. Print-service providers that have invested in digital equipment july have a big advantage in this area through the elimination or reduction in use of prepress chemicals.

InfoTrends believes that, in the current economic downturn, the demand for more effective (through versioning) and more cost-effective short runs will only exacerbate the demand for wide-format digital printing. We believe the ability to localize marketing efforts to the in-store level should help print-service providers who support the all-important retail segment of the wide-format-graphics market. One of the indicators from the recent InfoTrends study was that five times more print buyers expected to increase their expenditures on wide-format graphics over the next 12 months than expected to decrease. That number is (hopefully) good for all different types of print-service providers, but those that have adopted digital printing processes are more likely to be able to capitalize on this type of increased business activity.

Tim Greene has worked at InfoTrends (formerly known as CAP Ventures) since 1997 and been the director of InfoTrends' Wide Format Printing Consulting Service since 2001. He is responsible for developing worldwide forecasts of the wide-format-printing market and conducting primary and secondary research. Greene holds a bachelor's degree in management from Northeastern University. He can be reached at tim_greene@infotrends.com.

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns3 weeks ago

Columns3 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note2 weeks ago

Editor's Note2 weeks agoLivin’ the High Life

-

Marshall Atkinson2 weeks ago

Marshall Atkinson2 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

News & Trends1 month ago

News & Trends1 month agoWhat Are ZALPHAS and How Can You Serve Them in Your Print Business?