Digital Printing

Published

18 years agoon

When I was a boy, my grandfather taught me how to fly fish in the streams of southeast Pennsylvania. Years later I tried teaching myself how to tie the flies, and I have to admit that my talents clearly lie in other areas. But I do know that it is necessary to tie a fly pattern so that it looks natural from the perspective of a fish in the water.

Similarly, for those of us who analyze market and technology trends, it is important to provide data and analysis so they are understandable and meaningful to the particular market groups that use them. Let’s admit that there are several types of companies—manufacturers, distributors, print shops, and print buyers—participating in each segment of the specialty-graphics market. And each group has a specific set of needs and interests. Regardless of their position in the market, however, every business wants to know what it needs to do to remain competitive. Right now, the questions on everyone’s mind pertain to the growing role of inkjet printing technology.

You may have heard that inkjet printing will soon replace significant areas of analog printing. In some cases it already has. For example, the US inkjet market for wide-format graphics will top $6 billion in sales for 2005, and this market is still growing in terms of both volume and value. This growth has attracted much competition, resulted in increased pressure on profit margins, and presented challenging decisions for graphics printers to make.

In many shops, inkjet technology has actually proven to be complementary with traditional printing techniques. In others, inkjets have made far less of an impact than predicted. If we look at screen printing for a moment, there is no question that technology advancements have allowed inkjets to economically produce longer runs profitably and thereby capture shorter-run work from screen printing. At the same time, however, direct-to-plate technology has reduced the economical run length offered by offset lithography. This creates a situation that may force some screen printers to analyze their own business model before determining what technology they will invest in next.

The strides made in inkjet and other technologies doesn’t spell the end for screen printing, though. For example, while it will not be too long before UV inkjet printing overtakes UV screen printing for the production of graphics, this does not mean that UV screen printing will altogether go away. The fact is that when any mature technology is challenged by an innovative new process, the position of the mature technology in the market will change. For users of the mature technology, it’s important to keep its future success in perspective.

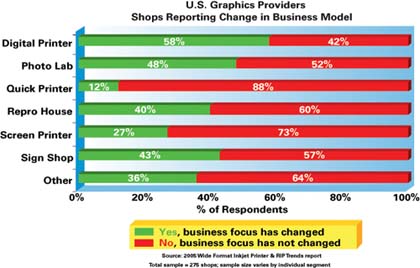

Many shops are beginning to do just that, as evidenced by a recent survey Web Consulting conducted and released in June 2005 on users of wide-format inkjet printers. As a result of digital printing and other changes in the market, many shops indicated that their business model and focus have changed in the last five years (Figure 1). Still, as I’ll discuss in the next section, not every shop has experienced such changes.

Where to cast your line

In the past, print markets were typically analyzed based on the technology used (silver halide, screen printing, lithography, etc.) and by historical markets served (electric signage, reprographics, etc.). After a decade of growth in wide-format inkjet technology, these divisions are almost impossible to recognize today, so we now segment and analyze by application. Looking at the producers of various types of applications, we find that not all shops are interested in—or feel threatened by—inkjet technology. There is no universal “Keeping up with the Joneses” mentality here.

This is what makes the specialty-graphics market so in-teresting. On one hand there are those shops that are quick to beta test and invest in the latest technology. And at the op-posite extreme, we have shops will little or no interest in ink-jet technology. During another recent market-research project, Web Consulting questioned one group of graphics-business owners about why they have not invested in inkjet technology. Some had misconceptions about inkjets, such as inkjet isn’t permanent or that it is not able to produce outdoor banners. Others stated there is not enough demand for inkjet printing in their markets or that the technology is just too compli-cated to learn.

Reeling in the benefit of inkjets

Many of us were trained to think of printing costs in terms of a dollar-per-square-foot model. But situations are rare when the cost of inkjet printing is less per square foot that that of an analog printing technology. It is important to view the advantages of inkjet printers in a slightly different way.

First of all, inkjet technology does not offer a simple one-to-one replacement for traditional analog technologies. Nor can its capabilities be sold in the same manner as traditional print methods. Inkjet offers unique opportunities. For example, it has been well publicized that inkjet can satisfy rapid (even same-day) turnaround. Inkjet also makes it much easier to print the same image in various sizes.

In addition, many screen printers are seeing the “print then warehouse” approach to production changing as their customers demand shorter runs and more customized output. The cost savings that come from being able to store artwork on CD rather than remaking or storing screens only adds to the attraction of inkjets.

Will graphics screen printing go away? Of course not, but its position in the market will continue to change. And inkjet’s position will only continue to strengthen as more shops understand the differentiating value of digital printing.

Swimming ahead

So what’s ahead for the US market for wide-format inkjet graphics? Here are my predictions:

• Overall, inkjet printing will continue to grow in graphics and will successfully address and develop many new applications. There will not be uniform growth, however, as some areas will grow at the expense of other technologies—both digital and analog.

• Wide-format aqueous printers will continue to lose their share of the market, but that doesn’t mean that these printers will go away. In fact, aqueous printers will continue to capture certain application areas that are best served by that technology.

• Growth will continue in solvent printers, including eco- and low-solvent models.

• Flatbed inkjet printers (both UV and solvent) will continue to be the leading growth segment for wide-format graphics. And, yes, there will be plenty of demand to support continued market growth.

With competition, success will not be universal. But printers can increase their catch from specialty-graphics production by understanding today’s technologies and market conditions and making educated projections about the future.

The opinions and recommendations expressed in this column are Mr. Flippin’s and not necessarily those of Screen Printing magazine.

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Art, Ad, or Alchemy1 month ago

Art, Ad, or Alchemy1 month agoF&I Printing Is Everywhere!

-

Case Studies1 month ago

Case Studies1 month agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Andy MacDougall1 month ago

Andy MacDougall1 month agoFunctional and Industrial Printing is EVERYWHERE!

-

Editor's Note1 week ago

Editor's Note1 week agoLivin’ the High Life

-

Columns2 weeks ago

Columns2 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

Marshall Atkinson1 week ago

Marshall Atkinson1 week agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Press Releases2 months ago

Press Releases2 months agoBig Frog Custom T-Shirts & More of Round Rock Celebrates Grand Opening