Digital Printing

Published

17 years agoon

Every year the analysts here at InfoTrends are asked to write a forward-looking document we call the Road Map. This document’s intention is to provide some insight for clients on what they can expect in the upcoming year. Here are some of the highlights from the Road Map that I am preparing:

Dynamic year for inkjet

OK, I admit I probably write something like that every year, but this year I expect there to be a veritable avalanche of new inkjet product developments unveiled at or around DRUPA 2008. For those who are not familiar with it, DRUPA is a huge print show held every four years in Dusseldorf, Germany (usually in June) that is aimed at commercial printers. When I say huge I’m talking about 19 halls and 2.8 million square feet of exhibit space.

Because commercial printers typically print very high volumes, a lot of the development of inkjet printers, inks, and print media has been done with commercial print in mind. Of course, like screen printing, commercial printing really consists of a number of applications like direct mail, labels, magazines, catalogs, books, and so forth. For the most part, inkjet plays a very small role in these applications today because many of these applications are primarily black-and-white, have limited requirement for the use of a wide variety of substrates, and are long-run print jobs—none of which has historically been the strength of inkjet technology.

Among those applications identified above there are two that InfoTrends believes will be addressed by the developments out of DRUPA: labels and direct mail. We have already been introduced to separate technology innovations from leading manufacturers that are aimed at those two markets that will be unveiled at DRUPA. We have to believe there are many more that will be introduced that will have an important impact on the commercial printing market because they present the ability to use color, use specialty substrates, and add variable data—even while running very high volumes at production speeds. This matters because as inkjet speeds go up and running costs go down, digital and inkjet will have magnified impact on both commercial printing and screen printing.

Consolidation

There have been several big consolidating actions in 2007 that we think will lead to some important benefits to end users. The three actions that have the biggest potential are HP’s acquisitions of ColorSpan and NUR, EFI’s taking a piece of Raster Printers, and the deal between Gandinnovations and TA Associates, the venture-capital company.

To me, HP’s acquisitions of ColorSpan and NUR are really important because these two companies both had developed leadership positions in the market segments they served. But I believe they were limited by access to the capital they needed to simultaneously support their installed base, grow their manufacturing capacity, and research and develop new products. I think HP is taking the long view by making these acquisitions instead of striking private-label deals with these manufacturers (or a supplier just like them) to fill out a wideformat UV-curable-inkjet portfolio.

For EFI, obtaining a piece of Raster Printers Inc. is most likely a portfolio filler since Raster plays only at the low end of the UV-curable-inkjet market. But the deal should give Raster the additional capital to continue to develop new products. Along the same lines, Gandinnovations has received an investment from TA Associates and struck a deal with CIT Group to offer financing of its high-end wide-format printers. These deals indicate that there is very strong potential in the UV-curable- inkjet market, of course, but they also should allow new products and easier access to those products, both of which should benefit end users.

Looking forward, I would say that even though there has been some consolidation already, there are still more than 30 manufacturers of wide-format UV-curable inkjet printers. With the combined HP-NUR-ColorSpan and EFI-Raster Printers and a stronger Gandinnovations, it seems that some of the other companies would be better off pooling their resources to compete against these big, strong market leaders. This is especially true because the back-end revenue stream—ink—is also under pressure by third-party ink manufacturers. InfoTrends believes some of these independent companies are likely to be acquired or merge with others to position themselves to compete in a market that is red-hot and already very competitive from a manufacturing standpoint.

At the same time, however, there are other manufacturers of wide-format printers that are likely to enter the wideformat UV-curable-inkjet business in the coming year. The number of industry players may not be lower at the end of 2008, but we certainly think the list will be different.

Globalization

This is one that won’t go away. For years now we have seen a growing influence on the US market from overseas manufacturing. The same is true in Europe. In a recent study we conducted on the state of the printing market over there, the influence of global suppliers was identified as one of the leading concerns about the market—particularly the Chinese and Eastern Europeans. My interpretation of the data is that printers in the European market are worried that because manufacturing costs are very low in these markets due to lower labor costs, their customers will look for new suppliers from these markets—or will use the low prices available from these manufacturers to pressure prices downward in their markets.

There is an upside to this impact for printing organizations. Consider that more than half a dozen Asian manufacturers are participants in the fast growing sector of UV-curable-inkjet manufacturing and that these companies and their North American distribution have to compete with the HPs and EFIs of the world. With big distribution companies like Nazdar and Fujifilm Sericol now pushing these other models, there are likely to be a lot of hardware deals to be found in 2008. I have previously written about another trend in the market that we see as a by-product of globalization, and that is greener printing. Based on the strong demand for greener printing products worldwide, there have been some developments in ink and media products that are likely to have a major impact in North America in 2008.

Digital signage

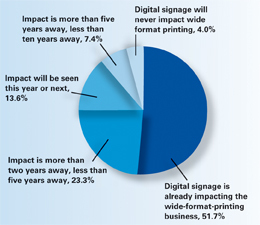

In that same study we did in the market in Europe we found that one of the top concerns that many printing organizations have about their businesses is the threat posed by digital signage systems. More than 50% of the printing organizations surveyed told us they think digital signage is already negatively impacting the wide-format-printing business, while only 4% indicated that they think there will never be an impact (Figure 1).

We think this is more of an issue in Europe than it is in the US at the start of 2008, but there are many indicators that digital signage is seeing wider market acceptance, and that will impact certain segments of the printing industry. When I look at some of the long list of retailers that are either using, launching, or piloting some type of digital signage system, I see companies like Adecco (UK), Borders (US), Hilton Hotels (US), Harrod’s (UK), Liberty Travel (US), McDonald’s Restaurants (US) Muvico (US), Pathmark (US), Subway Restaurants (US), Wal-Mart (US), and many more.

I see that this trend is cutting across vertical segments and across international borders and will have an impact in the US market in 2008 for applications like point-of-purchase graphics. It also should be noted that the digital-signage industry now has its own industry group, the Digital Signage Association, that will work to raise the profile of successful digital-signage implementations around the world.

The year ahead

I find it an interesting and fun exercise to try to predict what will happen in the year ahead, especially in a dynamic market like wide-format digital printing. (For the record, I shot about 65% with my predictions in 2007). I believe the fruition of the predictions that I have specified in this article represent both opportunities and threats for printing establishments in the US.

My final prediction for this article is that in 2008 printing organizations will continuously hear analysts and consultants in this industry stress the idea of moving beyond just selling print and becoming more of a partner to customers by using creativity to maximize their investments. I agree wholeheartedly with that analysis, because with growing competition from an expanding installed base of wide-format printers on the print-for-pay side, and a growing installed base of wideformat printers within organizations—or what I call the print-for-use market— I believe it will be increasingly difficult to compete on a cost-per-square-foot basis. The most successful printing establishments will be those that become extensions of their clients’ marketing organizations, offering marketing solutions that may include traditional design, print, converting, finishing, and installation services, but may also include preparation or management of content for digital signage systems.

Tim Greene has worked at InfoTrends (formerly known as CAP Ventures) since 1997 and been the director of InfoTrends’ Wide Format Printing Consulting Service since 2001. He is responsible for developing worldwide forecasts of the wide-format- printing market and conducting primary and secondary research. Greene holds a bachelor’s degree in management from Northeastern University. He can be reached at tim_greene@infotrends.com.

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns3 weeks ago

Columns3 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note3 weeks ago

Editor's Note3 weeks agoLivin’ the High Life

-

Marshall Atkinson3 weeks ago

Marshall Atkinson3 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

News & Trends2 months ago

News & Trends2 months agoWhat Are ZALPHAS and How Can You Serve Them in Your Print Business?