Articles

Published

20 years agoon

In September of 2001, Screen Printing‘s sister publication, The Big Picture magazine, published “The Future of Printing,” an overview of emerging digital signage technology and its likely effect on display-graphics printers. In that article, I opened with the following statement: “In the future, most of the places now occupied by conventional signs, posters, banners, light boxes, billboards, and P-O-P graphics will be occupied by digital-display devices.” My contention was that familiar printed graphics will ultimately be replaced by electronic devices and media, including large-format plasma or LCD flat screens, LED signs, electronic smart paper and other types of e-films, or substrates used with projected images.

Now, more than two years later, I see no evidence that I was overstating the case. In fact, despite the economic slowdown, turmoil in the business world, and skepticism or ennui on the part of end users, major new projects continue to be implemented. We will look at a few of these on the following pages.

Tuning in to the latest trends

Over the past two years, several unexpected new developments in technology and product availability have helped hasten along the adoption curve for digital signage. The most surprising of these is the new Mitsubishi smart billboard initiative, which licenses a full-color reflective e-film from New York, NY-based Magink Display Technologies (www.magink.com). Read about how this technology will change outdoor advertising under the section “The inkjet-killer billboard.”

Less surprising is the ascendancy of LCD technology, as prices drop and formats grow. Couple these trends with new developments in inexpensive “turnkey display systems,” and suddenly you are looking at digital signs and displays that are far more accessible for the uninitiated. If this is what you were waiting for, read the section on “Cheap digital displays and the emergence of the LCD.”

On the more speculative front, the emergence of OLED technology has everyone talking about the ultimate potential for thin, flexible display interfaces that could conceivably be integrated into any surface or structure. Although OLEDs won’t begin impacting graphics in a serious way until later in this decade, it’s not too early to begin asking what kind of business models the graphics providers of the not-too-distant future will be embracing. Learn more about this technology in the section “The future of OLEDs.”

It’s important to note that the relevance of these developments has not been lost on screen-printing and digital-imaging companies. Today, at least a dozen of these conventional graphics producers are introducing electronic-display products to supplement their printed graphics.

The inkjet-killer billboard

The modest-looking signs in Figure 1 are far more momentous than they may at first appear. The billboard in the photo is a demo model manufactured by Mitsubishi Electric Corp. using full-color “e-ink” technology licensed from Magink Display Technologies. Such billboards have been installed in Brussels, London, Tokyo, Toronto, and Panama City, and they have drawn significant interest from the world’s major billboard operators and out-of-home advertising agencies.

The big deal is that Magink’s reflective display substrate allows the image on the sign face to be changed remotely, simply by sending a bit-mapped file. No printing and no installation. Keep in mind that this is a reflective technology, and not an LED light-bulb matrix display. This means that it is visible in daylight the same as any other billboard and must be illuminated at night using standard floodlights.

The resolution of this particular version of Magink is about 20 dpi, similar to that of the “airbrush” billboard printers of the early 1990s. The display shows faint grid lines where the 7 x 14-in. Magink modules fit together to form the larger face, much in the way outdoor LED boxes are manufactured. At typical viewing distances, the grids are barely visible. There is no inherent limitation to the size of Magink technology billboards.

The display substrate itself is a full-color, programmable electronic medium created by sandwiching an electronic paste between thin sheets of glass or plastic. When a new electronic signal is transmitted to the backplane, the magic ink surface changes the color wavelength and density of the light it reflects to the viewer. Images sent can be as small as a few hundred Kb, and very little electrical power is required to change the graphic. Once the image is in place, no current at all is required to maintain it.

The Magink image isn’t yet perfect. There are some issues, for example, with getting a bright red. But I’ve seen these billboards in real life, and the technology is more than commercially acceptable.

How you interpret the economic viability of this new technology depends on your point of view. At $80,000-100,000 a copy for a poster-panel-sized billboard (about 12 x 24 ft), it is certainly far less expensive than an LED spectacular of the same size. However, the Magink board isn’t self-illuminating and can’t yet run full video in commercial appli-cations, so the comparison isn’t fair.

When stacked up against a standard billboard, the case becomes clearer. Although the Mitsubishi signs will initially cost eight to ten times more than a conventional sign, we can tally significant savings by eliminating printing and installation costs. On the other side of the ledger, operators can theoretically bank more revenue per board, because multiple ad spots can be scheduled for the same sign. Intangible benefits, such as the ability to schedule ads according to traffic patterns or time of day don’t show up on the balance sheet, but do improve the overall effectiveness of the billboard. How the numbers work in real life is about to be proven.

Mitsubishi has now manufactured and installed six 10 x 20-ft units at various “live” customer sites around the world. Five of these clients are large-scale media operators, and the sixth is a large sign company. According to Mitsubishi, it is ready to begin mass production of the sign system immediately.

Cheap digital displays and the emergence of the LCD

If you have been following the emergence of digital-messaging technology, you’ll have noted that the majority of projects appear to be large-scale networked installations, usually deploying plasma flat screens as the display interface. However, other current developments in real-world installations have been slightly overshadowed by these projects, because conditions have changed since they were contracted. In fact, the trend toward more accessible and affordable digital-signage systems is continuing to gain momentum.

While plasma flat-screen technologies will continue to have a place in the nascent rollout of digital-messaging systems, it is becoming more and more clear that LCD screens will increasingly be the popular choice for small- to mid-format signs. LCD is a mature technology driven by a number of competing manufacturers, offering a wide range of size formats. The bigger end of the format range is growing quickly: Sharp (www.sharp-usa.com) offers a 30-in. diagonal display, Rainbow Display (www.rainbowdisplays.com) rolled out a 37.5-in. composite unit earlier last year, and Clarity Visual Systems (www.clarityvisual.com) offers a 40-in. model. This moves LCDs into the mid-range of the plasma-screen-format range, but at significantly lower pricing. LCD screens don’t carry some of the unwelcome baggage associated with plasma technology, which include relatively short life, brightness issues, image burn-in, and lack of robustness.

What about prices? The long-expected LCD price decline has materialized: Today you can buy a 17-in. diagonal display in quantity for under $300. The “commodity” break seems to be around the 19-in. mark right now, with prices dropping rapidly toward $500. That’s getting up toward a respectable format. While you wouldn’t think of hanging a 19-in. banner in a bank lobby, the same-sized digital LCD presentation can easily command an area of that size. As costs for LCD interfaces continue to fall, it becomes easier to think of them as displays instead of computer screens.

Concurrent with the emergence of LCDs as a viable and affordable sign technology has been the development of plug-and-play digital sign and display units. These all-in-one digital appliances handle delivery of content to the LCD screen, usually providing some level of scheduling and content management in the process. Unlike the very high-priced custom systems that have marked the early implementation of electronic displays, turnkey systems allow screen printers and other graphics providers to begin thinking about offering digital signs to smaller customers.

Some of the new digital-signage products are in the form of integrated kits, such as the POPdart unit shown in Figure 2 from Seattle, WA-based Artistic Resources and Technology, or A.R.T. (www.artdart.com). This standalone digital sign system is designed to deploy content on an 18-in. LCD screen, such as the one shown behind the counter in this Seattle-area Subway store. The POPdart is an enclosed touchscreen that incorporates a networked Windows 2000-based processor within the unit.

The store owner wanted to increase incremental sales through daily specials, but had previously used hand-written paper signs to announce them. In addition to selling the display, A.R.T. develops the promotional content and trains employees on changing out messages. The company created a very basic point-of-entry screen that allowed employees to select from one of eight different “shows.” The interface was not unlike the automatic ordering machines they were used to. According to A.R.T. director Brandon Rudd, the client identified approximately $100/day or $30,000/year in additional sales that are attributable to the sign.

Minneapolis-based AlivePromo (www.alivepromo.com) has also been successful developing a line of turnkey, standalone displays, including a flat-screen point-of-purchase unit called the Lure. The Lure sells for about $1000-1800 in bulk and is designed to be wall-mounted or set into a wheel-based assembly; a literature rack is optional. The processor is built into the display and can be updated remotely or via portable flash-memory drives (so a high-speed phone line isn’t necessary).

According to the company, the goal is to provide resellers the core technology components that will allow them to lease or sell the system and also provide customers with ongoing content and management services. AlivePromo offers display systems in sizes from 17-60 in. that carry price tags up to $6500. As you can see from Figure 3, which depicts the company’s Reliever model ($1000-5000 for a typical men/women’s room combination), there is no limit to the promotional potential for changeable signs, especially when you have a captive audience.

The future of OLEDs

In the future, just about the time LCDs have replaced every CRT screen still flickering, a new, truly disruptive display technology will have slowly begun to render the flat screens obsolete. Just as flat screens are much thinner and more versatile than clunky TV-type monitors, OLED screens are far thinner and more versatile than flat screens. These days, no technology gets to be king for long. OLEDs are no vaporware delusion of a demented engineer either: You can see these thin, full-color interfaces on electronic appliances starting now.

OLED is spelled out as Organic Light Emitting Diodes (also known as LEPs or Light Emitting Polymers). These descriptions are accurate as far as they go, but are missing the key term–“Incredibly Small” (ISOLED). OLEDs function much the same way as the LED matrices that make up giant electronic billboards, except that each polymer “lightbulb” is microscopic. When an electronic signal is applied, each of these microscopic pixel points emits brilliant light in the appropriate wavelength, creating an output interface that is conceptually similar to a TV, computer monitor, or any other RGB device. Ironically, one of the best ways to manufacture OLEDs is using piezo inkjet printers not much different than those used in wide-format graphic production. OLED media can be economically mass-produced by printing a polymer matrix on glass (and eventually plastic).

As a display technology, OLEDs have two powerful attributes. The first is thinness. Because they are self-illuminating, OLEDs don’t require backlighting. They can be as thin as a credit card, yet brighter than an LCD. The second attribute is flexibility. When the last remaining technical obstacles are removed, plastic OLEDs will be produced that conform to any surface. Think about automotive dashboards and electronic apparel. Figure 4 shows another possibility that is being talked about among the industrial-design crowd: It is likely we will see active-matrix computer interfaces that unfurl from a smaller appliance by the end of the decade. If you would like to see an amazing demo of a full-motion video spot running on a sheet of flexing plastic, visit www.universaldisplay.com.

From a graphics point-of-view, the potential of OLED displays should be obvious. And if you aren’t convinced this technology is going to happen, consider some of the players who have invested heavy stakes: Eastman Kodak, Epson-Seiko, Motorola, Pioneer, Royal Phillips Electronics NV, Samsung, Sanyo, and Sony. At the moment, the primary interest of these corporations is in digital appliances and consumer electronics. It will be several years before anything like a high-resolution, active-matrix large-format sign face is commercially available for graphics display. But Sony and Toshiba have already demonstrated 13- and 17-in. displays, respectively. OLED matrices also can be configured so they’re addressable in sections, rather than rows and columns or individual pixels. This drastically cuts expenses and allows much larger formats to be manufactured. Ultimately, no inherent size restrictions apply to making the OLED media itself.

Retail rollout

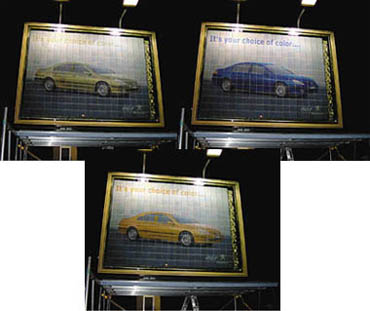

The list of major retailers, convenience stores, fast-food chains, and brand stores taking the digital-signage plunge is growing every week. Among the more recognizable names that have experimented with digital-signage networks are Macy’s East, Eddie Bauer, Office Depot, Bloomingdales, Store 24, Taco Bell, Sanborns, US Army PX, Payless ShoeSource, Honda, Jewson, AT&T Broadband, SBC Ameritech, General Motors, Ericsson, and Volkswagen (see the examples in Figures 5A-5C). In terms of customer satisfaction, it’s fair to say that reactions have been mixed, but there also appears to be a growing critical mass of acceptance.

Typical of the most successful projects has been Office Depot’s large-scale national deployment of an in-store plasma-screen network, with heavy concentration in Dallas and Denver area stores. Developed and implemented by Knoxville, TN-based Multi-Media Solutions (www.m-media.com), the initiative includes over 30 properties, with up to eight 42-in. diagonal Fujitsu Plasma-Vision screens in each. The project included retrofitting existing stores as well as integrating the sign network into new construction.

According to Multi-Media president Mike White, the key to the success of the project has been a solid strategy from the beginning and a system that allows maximum flexibility in executing it. “There are a lot of different displays that can play your content,” says White. “But if there is not well-planned, integrated content management from the owner of the system, it will not succeed over the long run.”

The Office Depot system can select from up to eight different static, animation, or video presentations to display on any screen at any time anywhere in the system. Content is generally controlled remotely by headquarters in Del Ray Beach, FL, but can also be customized by the store manager. Although some customers prefer the system vendor to manage content, Office Depot has assigned one home-office staff member to run the system nationwide. Typically, the signs run product-specific promotional spots, alternating with Office Depot brand support and store-specific messages. MPEG content is usually supplied by vendors or Multi-Media Solutions, but can also be as hands-on and immediate as a presentation originating from an in-store computer.

If you’re in the graphics business, it’s reasonable to wonder how such an ambitious digital-sign network will affect existing conventional visual communications such as printed signs, displays, and banners. According to White, the larger challenge is to develop a blend of conventional and electronic technologies appropriate for the overall strategy. “We are probably replacing some printed signs, but that’s not the real issue,” says White. “All the customer is looking for is the best combination of technologies for the job.”

Nevertheless, what is interesting for anyone who has recently made the transition from analog to digital printing is that your high-performance digital inkjet printer now represents the technology labeled as “conventional.”

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns3 weeks ago

Columns3 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note3 weeks ago

Editor's Note3 weeks agoLivin’ the High Life

-

Marshall Atkinson3 weeks ago

Marshall Atkinson3 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

News & Trends2 months ago

News & Trends2 months agoWhat Are ZALPHAS and How Can You Serve Them in Your Print Business?