Digital Printing

Published

17 years agoon

In my last column I described one of the valuable tools I use in my analysis of the wide-format digital-printing market. One of the critical elements of that analysis is the influence of buyers and end customers. Great consideration must be given to what print buyers and end users are trying to accomplish with their wide-format prints. The last two months have seen end users influencing the wide-format-printing market in a very important way regarding the environment. I believe that we are now at what Malcolm Gladwell described in his best-selling book of the same name as the “tipping point” for environmental consideration in the printing industry—a point that’s advancing thanks to print buyers and end users.

One of the companies that I know is betting on the growing demand for green prints is XLprints in Santa Clara, CA. XLprints (www.xlprints.com) is a company founded in 1991 by Silicon Valley entrepreneur Andy Lotia. The shop uses several of EFI’s VUTEk wide-format solvent, UV-curable and dye-sublimation printers. It is also a 3M ScotchPrint authorized manufacturer.

XLprints recently launched an initiative called Yield to Green, an effort to introduce inks and media that are significantly better for the environment This means products that are environmentally safer in their manufacture, use, and disposal, including—but not limited to—reduced VOC emissions, increased recycling opportunities, and enhanced biodegradability.

The company has a VUTEk 3360 running BioVu inks and has just taken delivery of a new VUTEk 5330. The company plan to run BioVu inks with alternative media, including some hand-picked from Ultraflex and Dickson Coatings. XLprints is in the process of evaluating other print media as well and is looking for more suppliers that have green products in development. Steve Beard, who’s worked on this for two years and is now responsible for Yield to Green business development, indicated that there are several other major issues for printers hoping to turn green-speak into reality.

“The biggest issue is that currently available green inks and media are typically more expensive, so we have to be able to charge more for those prints. This means having to explain to customers that green printing can be more expensive and selling them on the idea that there are costs involved when they say they want to go green,” he says. Beard also indicates that there are obstacles to selling when print buyers are unaware that their own company or organization has announced intentions to give preference to the purchase of environmentally safer products.

So why the Yield to Green effort? “We also have business reasons for doing this,” Beard explains. “We want to grow and be more profitable, like everybody else. This is not sheer altruism, but we hope that doing the next right thing can be a winwin- win; for us, our clients, and the environment. The idea of green printing is not just for so-called tree huggers any more. As environmental realists, we’re seeking progress not perfection. Today, eco-awareness has found its way into the corporate and municipal consciousness. The real benefits will come when all of this becomes part of the mainstream process.”

Jane Cedrone, marketing communications manager at EFI-VUTEk, says, “Certain print-buying customers are pulling for green printing through their own green initiatives, so some printers really have to have green printing capabilities in order to even bid on these jobs.” The list of companies that are creating this pull includes major branded-goods manufacturers and major retailers.

Environmental issues have been at the forefront of several recent, more prominent wide-format-industry events. The environment was one of the hottest topics at the FESPA Directors Summit, where approximately 100 of the leading screen- and digital-printing companies in Europe convened in Geneva, Switzerland this Spring. Many of the print-service providers at that event indicated that their customers were asking for greener printed materials but that there was still a lot of price sensitivity and few options for green printing supplies in the European market. One of the screen- and digital-printing companies I talked to acknowledged the purchase of several new wide-format water-based printers to add to the shop’s printing capacity to keep up with demand from one of its biggest customers, a retailer based in the UK.

At the ISA show in April, companies like DuPont and Durst highlighted the green aspects of the materials they supply. Durst indicated that it is the only one of the wide-format digital-graphics vendors that sells UV-curable inkjet printers that use a VOC-free UV-curable inkjet ink. Durst also issued separate press releases about how two customers of theirs, Ferrari Color and Light-Works, have adopted Durst printers as part of their green printing initiatives. DuPont indicated that its Tyvek, which has been a very popular banner substrate in the water-based wide-format- inkjet-media market, could be used as an alternative to vinyl by print-service providers. DuPont claims Tyvek is greener than vinyl because it is recyclable and the Tyvek manufacturing process is greener than that of vinyl. Tyvek also is lighter weight (which should reduce some shipping costs) and has excellent tearresistance properties. Candidly, I have no way of verifying the claims made by different manufacturers about the green properties of their products, but it is noteworthy that different suppliers are now often leading with those properties as part of their marketing strategies.

It also is true that many print-service providers in the wide-format-imaging market are considering their printing environment when it comes to the new printers they are evaluating for purchase. The data we collect at InfoTrends shows that the market for mild-solvent and eco-solvent inkjet printers is still seeing very strong growth, whereas printers that use robust solvents are seeing steep declines.

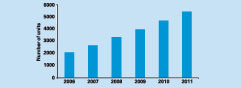

Another effect of greater environmental awareness is the tremendous amount of growth we are seeing in the market for wide-format UV-curable inkjet printers (Figure 1). While the biodegradability and recycling potential of UV-inkjet-printed materials is not clear, many print-service providers are buying UV-curable inkjet printers as an alternative to solvent-based inkjets. One of those companies, FedEx-Kinko’s, has cut-vinyl and water-based wide-format printers in its Sign and Graphic Centers for smaller wide-format jobs, but did not want to invest in solvent-based wide-format printers for its production centers, partly because of the downside potential for solvent. Instead, FedEx-Kinko’s opted for wide-format UV-curable inkjet printers for its production facilities.

I and the analysts at InfoTrends believe the move to green printing in the wide-format digital-graphics business is just getting started. Even though product development in the past few years has really focused on the printing environment with mild-solvent or eco-solvent inks, we think manufacturers will focus now on bringing green principles to the print itself. Media products such as biodegradable PVC and Evergreen fabrics are good examples of early market entries. It’s still pretty early to tell how some of these developments will manifest on the hardware side, but a recent flurry of announcements related to wide-array-printhead technologies suggest dramatic improvements in the speeds that are achievable, particularly in UV-curable inkjet printers—and even in water-based printers. In the past half-year we’ve seen products that integrate wide-array-printhead technology from a number of companies, including Hewlett-Packard, Sun Chemical/Inca Digital, Olympus, DaiNippon Screen, and more. It should be noted also that we have seen many new ink suppliers enter the ink market for wide-format UV inkjet printers, which usually means that the average selling price per liter will decline.

Join the green scene

Printers who have already adopted green printing processes are ahead of the curve—not just because they are doing the right thing from an environmental standpoint, but also because they can differentiate their services by offering green printing to a growing market of discriminating buyers. Additionally, by pushing green printing, these companies are raising the awareness of the issue with print buyers (which includes informing them that green printing is more costly). Finally, there is a real possibility that at some time in the future, restrictions on the use of robust solvents and non-biodegradable and non-recyclable print media could become the law of the land. Adopting green printing processes early accelerates helps eliminate some of the hurdles that come when shops take on a new piece of equipment or start using new supplies.

Tim Greene has worked at Info Trends (formerly known as CAP Ventures) since 1997 and been the director of InfoTrends’ Wide Format Printing Consulting Service since 2001. He is responsible for developing worldwide forecasts of the wide-format- printing market and conducting primary and secondary research. Greene holds a bachelor’s degree in management from Northeastern University. He can be reached at tim_greene@infotrends.com.

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns3 weeks ago

Columns3 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note3 weeks ago

Editor's Note3 weeks agoLivin’ the High Life

-

Marshall Atkinson3 weeks ago

Marshall Atkinson3 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

Case Studies3 weeks ago

Case Studies3 weeks agoScreen Printing for Texture and Depth