Articles

Published

19 years agoon

As a baseball fan (a Boston Red Sox fan, to be specific), I’m used to watching my team fall from the top of the leader board in late September each year. But as an analyst and observer of the wide-format printing industry for Web Consulting Inc., I was somewhat surprised to see the same sort of rapid shakeout occur in the market for wide-format graphics during 2003. Last year was a time of significant change, both in terms of the technologies used to print large-format images, and, more significantly, in the mix of media on which graphics are being printed. And 2004 promises more of the same excitement

Output technology

We at Web Consulting define wide-format applications as those with print widths of 24 in. or more. Data we’ve collected in-dicate that, overall, the global market for wide-format graphics produced by all imaging methods is growing. But not all imaging technologies are enjoying a share of that growth. Whereas inkjet printing and offset lithography for wide-format graphics are seeing an increase in volume (square feet printed annually), other technologies are showing signs of decline–most notably screen printing and traditional photo imaging.

However, even among technologies enjoying market growth, we see stark contrast–while offset lithography’s output volume is growing by 2-4% a year, inkjet is experiencing an average growth in volume of 15% annually. Unfortunately, the value of inkjet output has not kept pace with its growing volume, and the revenue generated by the technology is not healthy. To put it simply, the value of wide-format inkjet output has reached a plateau.

Because the wide-format digital-graphics market emerged and matured in less than ten years, the ability to differentiate products and services became critical very quickly. But most people who participate in this market would agree that competition, a surplus of output capacity due to the number of digital printers in the field, and a lack of differentiation between most digital printers available today make it difficult to carve out a competitive advantage. These factors hint that value-added resellers will play a vital future role in the marketplace as the number of machines and endless combinations of ink and media continue to overwhelm and confuse many users.

If machines are not offering huge differentiation, users must develop other capabilities that add value before and after printing, as well as methods to sell those capabilities. It is fair to say that in most areas of the wide-format graphics market today, the ability to print has become a commodity. The 600-dpi print resolution on aqueous inkjets that raised eyebrows in the mid- to late-1990s is now taken for granted on all inkjet output devices, including solvent-based wide and superwide machines.

At Web Consulting, our business is to follow, interpret, and analyze trends in the global wide-format graphics-printing market. And our research over the past year has revealed some interesting changes–especially in the market for inkjet printing. Media usage is changing, print segments are blurring, and as devices using solvent-based and UV-curable inks continue to capture a higher percentage of the market, they are significantly transforming the types of prints being produced and the finishing procedures these prints must undergo.

A changing landscape

It is interesting to note that in the early 1990s, almost all of the substrates used by drop-on-demand inkjet technology were paper-based. The market was dominated by photobase papers, which were, at that time, some of the only substrates able to handle the ink-receptive coating layers and to absorb the water in aqueous inkjet inks. A lower-cost alternative was introduced in the form of alternative photobase products. These media offered print quality similar to traditional photobase papers, but at a lower cost because they used less expensive base stock. Today, however, paper-based substrates are in the minority of wide-format inkjet media and losing ground rather quickly.

While, in many respects, inkjet printing has matured to a level that makes it apparent the technology is here to stay, its ever-changing dynamics (product upgrades, new printer introductions, new application opportunities, etc.) make this a truly fascinating area to observe. In the sections ahead, we’ll consider current trends based on the findings of Web Consulting’s recently released annual industry report, entitled 2003 U.S. Wide Format Inkjet Media Trends. This report focuses on US inkjet-media usage, purchasing trends, and inkjet-media brand perceptions, and it will be updated and published again in October 2004.

The markets for digital wide-format graphics were historically separated by four walls and a roof–there were indoor applications and outdoor jobs. Solvent-based grand-format and superwide machines served the market for outdoor-durable billboard and display applications. Aqueous–and, to some extent, oil-based–machines served the markets for indoor P-O-P, exhibition, and photographic images. Today, however, no barriers exist, and most machines can satisfy the requirements for both indoor and outdoor wide-format graphics. The changes in inkjet-media usage support this phenomenon.

To understand the shifts in media usage, we must first understand how the markets and applications that are served by wide-format inkjet printing are changing. Remember that inkjet printing is only a relatively small part of the wide-format graphics industry. The global market for wide-format graphics is more than 38.5 billion sq ft (3.58 billion sq m). Web consulting estimates that wide- and grand-format inkjet printers today capture about 12% of that market volume. However, for those machines in the 24- to 87-in. printing-width range, more and more of the output is moving toward outdoor applications and increased image stability.

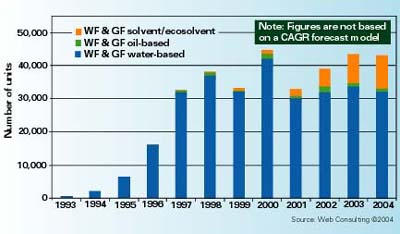

This trend has introduced a corresponding shift in media usage that mirrors the base of printers sold into the wide-format inkjet market. Despite their lower productivity compared to most other inkjet technologies, aqueous inkjets still dominate in terms of units sold and represent about 75% of total unit sales (Figure 1). The large installed base of aqueous inkjets explains why more than 80% of wide-format inkjet media consumed in 2003 was for aqueous machines (Figure 2). But the volume of media they use is projected to drop to only 60% within four years. This means that the media used by solvent-based inkjets not only will dominate in the grand-format market (machines with output widths of 100 in. or more), but also will capture more than 1/3 of the wide-format market previously dominated by aqueous inkjets.

This shift in media usage also affects ink usage and reflects how the market’s overall perception of quality is changing. For years, it seemed that the biggest and most important specification for a new machine and its related consumables was resolution. That is clearly no longer the case–nor was it ever, really. In 2003, roughly 1/3 of print-for-pay segments reported using aqueous dye-based inkjet inks. More than 60% of all applications were printed using pigment-based inks (aqueous and solvent-based), with oil-based and UV-curable inkjet inks capturing the remaining volume. We anticipate this trend toward ink systems that provide longer print life and durability will persist.

Based on annual research conducted by Vector Marketing (now Web Consulting Inc. in the US) and by Web Consulting’s UK office, the types and amounts of wide-format inkjet media being used in 2003 broke with old patterns of consumption. The amount of non-paper-based inkjet media purchased for the 24- to 87-in. wide-format sector became greater than that of paper-based media (Figure 3). And this change happened quickly. In 2000, about 60% of all wide-format inkjet media sold in the US was paper-based (coated-bond or photobase products). In 2003, the share of the US market captured by paper-based media was only 41%. And the decline in the use of paper-based media is expected to continue.

Coated-bond paper for both aqueous and solvent-based inkjets suffered the biggest loss of market share, falling almost 30% as a percentage of all media from 2002 levels. While the total volume sold remained unchanged, coated bond had a smaller piece of the overall market. The decline in use of paper-based media will only worsen as solvent-based media continues to grow in popularity and capture an even larger share of the wide-format market in the US.

It’s important to note that these changes in media use are not arbitrary or unexpected. They simply reflect the changing nature of the applications being served by inkjet technology.

The evolution of wide-format inkjet graphics

Application requirements are the main factors that influence what specific media types are selected for particular applications. These application requirements themselves are typically defined by the market the inkjet user is serving. Web Consulting identifies several primary end-user segments for inkjet technology, including photo labs, digital printers, sign shops, and screen printers.

Data collected for Web Consulting’s 2003 survey indicate that the importance of and reliance in wide-format inkjet printing is growing across all these segments. In other words, the revenue generated by wide-format inkjet printing represents an increasing share of a graphic producer’s overall business. Among shops interviewed for the survey, the percentage of sales generated by wide-format inkjet increased more than 20% from 2002 to 2003.

So if application requirements are driving the new trends in media usage, what kinds of jobs are being produced to support these trends? The application area that showed the greatest growth from 2002 to 2003 was banners (Figure 4). Banners have nearly doubled as a percentage of the overall application mix in three years, from 13% of total applications by volume in 2000 to 22% in 2003. Sign shops appear to be the strongest segment for this growth. From an equipment standpoint, the rise in banner printing is reflected by the recent increase in the adoption of solvent-based inkjets, as well as eco-solvent or lite-solvent printers.

Interestingly, Web Consulting’s research indicates that P-O-P/retail-display jobs have fallen as the leading application-area for wide-format inkjet printing. There is no doubt that P-O-P still represents the largest piece of the wide-format graphics market overall (jobs produced with all imaging processes), but inkjet’s slice of the pie is getting smaller. In fact, P-O-P has declined from a high in 2000 of 27% of all inkjet-printed applications to 16% last year.

US ad spending has experienced challenging times for a few years, and, except for companies that use wide-format digital printing, all of the traditional print-for-pay segments have witnessed a production decrease in P-O-P/retail graphics since 2001. However, in tracking general ad-spending trends in the US and comparing them to the performance of the wide-format graphics market, Web Consulting identified a positive trend–an increase in the quarterly wide-format P-O-P/retail-display sales during the third quarter of 2003 (Figure 5). The optimism seems to be contagious, as both the digital and screen-printing markets predict significant growth rates for this market beginning in the fourth quarter of 2003 and continuing into 2004.

Another bright spot that has emerged from the data we’ve collected is the market for outdoor graphics. In 2004, US advertising spending is predicted to grow by 3.6% while outdoor advertising spending is predicted to grow 4.0%. This should mean even better things for the growing non-paper-media market and for print shops that produce outdoor applications.

What’s the bottom line for media?

The changes that have occurred in the wide-format inkjet media market are significant. From a purchasing perspective, paper has become less important. Specialty media types are dominant and still growing. On a global basis, solvent-based inkjets are the fastest growing hardware segment, and banners produced on these machines have mirrored the trend by capturing the highest rate of growth of all wide-format inkjet applications. In many ways, the market for wide-format digital graphics is starting to look and act more like traditional printing markets.

Web Consulting identifies three general categories of media used in the production of wide-format graphics: paper and aqueous media, rigid media, and flexible plastics. Each of these categories represents roughly a third of the total volume of media used for wide-format inkjet printing (Figure 6). For its first 10 years, the wide-format inkjet market looked nothing like its analog cousin–paper-based media always dominated. Only a handful of printers could economically print onto uncoated vinyl. And, until very recently, getting digitally printed graphics onto rigid substrates meant printing flexible media, then mounting it on rigid material.

But as the market for wide-format inkjet-printing matures, we see paper-based media losing share while vinyl and other flexible plastics gain in importance. The wild card here is the success and adoption of inkjet flatbed printers. Web Consulting predicts that a large piece of the future media market for wide-format inkjet imaging won’t be roll fed–it will be a mélange of rigid board, metal, glass and other high-value specialty substrates traditionally served by screen printing. This is not to say that inkjet technology will capture all of that market; it won’t. But it will satisfy an economical need with certain materials and applications.

Flatbed inkjet printing is not the answer to all low-volume or specialty printing applications. It is perfect for those applications that use high-value substrates because it allows companies to reduce inventory costs. But today’s flatbed inkjets are expensive, and it is very difficult to justify one of those machines if a shop is printing on paper. Higher-cost media means that graphics producers can charge more for their printed output, earn greater profits from the jobs they produce, and more quickly see a return on their investment in flatbed technology.

Many of the companies that will lead the market in the future are not leaders today. And we can expect consolidation, both among the printing companies producing inkjet graphics and among the manufacturers of equipment and supplies for wide-format inkjet imaging. The last few years have been an interesting period for the wide-format inkjet-printing market, and it’s likely that next few will be even more fascinating.

About the author

Michael Flippin is vice president of Web Consulting, Inc., Boston, MA, a division of the global digital-strategy and market-research consultancy, Web Consulting, Ltd., Oxfordshire, UK.

Subscribe

Magazine

Get the most important news

and business ideas from Screenprinting Magazine.

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns3 weeks ago

Columns3 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note3 weeks ago

Editor's Note3 weeks agoLivin’ the High Life

-

Marshall Atkinson3 weeks ago

Marshall Atkinson3 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

Case Studies3 weeks ago

Case Studies3 weeks agoScreen Printing for Texture and Depth