Why screen printers should start planning now for selling or transferring their businesses.

Published

9 months agoon

WHETHER YOU’RE THE one on the edge of retirement or you’re the next in line to take over the company, succession planning can be an elephant in the room. However, businesses need strategies for making these transitions, and for identifying and developing new leaders in the first place.

We asked Mark R. Hahn, senior managing director of Graphic Arts Advisor — a mergers and acquisitions advisory and consulting firm focused exclusively on the printing, packaging, mailing, marketing production services, and related graphic communications industries – for his thoughts on preparing for retirement or the sale of a business.

Mark R. Hahn

Q: When should a business owner begin to work on his/her succession plan? How long does the process take?

A: Starting the process three or four years before the planned exit date is best. If we’re talking about a sale of the company to an unrelated party, the active sale process averages six to nine months. Sometimes events intervene, and a quicker time frame is certainly possible. If an owner is financially challenged, we run a much faster process to move the business quickly and avoid further losses. For a healthy business, the process can take longer to find the right buyer and get all the pieces into place.

Q: What are key steps toward successfully retiring?

A: It’s important to effectively work yourself out of the business. Get the next level of management and leadership in place well before you begin the sale process; i.e., work yourself out of a job over time. If the succession plan is to transition the business to the next generation, the most successful scenarios we see are when [members of] the younger generation work outside the family business for three to five years before joining the company, and then work in different departments before assuming a leadership position.

Q: What are options for succession planning?

A: Many owners would like to pass the company along to the next generation. However, that obviously requires the members of the next generation to want to be in the screen printing business. If the younger generation is interested – and, I must add, qualified – then a long-term plan is needed, and owner should expect to financially assist their children with seller financing or gifting. For larger, more successful screen printing companies, the generational transition becomes harder. The value of the business is simply too high, and the proceeds from a sale are too attractive. If there are unrelated owners, family transition may present problems due to disparate interests, and a sale to unrelated parties is more likely. Private equity sounds attractive because they have the funding sources to pay more cash at closing. However, many screen printing companies are below the size threshold or do not have a clear strategic vision and value that will attract financial investors.

Q: What are some of the biggest mistakes an owner can make during this process?

A: The most common mistake is waiting until the business starts to decline; buyers are buying the future, so go to market when times are good. Sell on the way up. Another closely related mistake is when sellers have an inflated sense of the value of the company and set unrealistic expectations. A good deal is fair to both sides and represents the performance of the company going forward. Not having the financial statements in order can be a major impediment to achieving the best results in a sale process. Get the books in order, spend the money to get outside accounting oversight, and tighten up internal reporting procedures. Buyers value accurate and well-organized information.

Q: What are the risks of poor succession planning?

A: Some owners get trapped running their companies much longer than they had hoped. If illness, an economic downturn, or another event intervenes, an owner can find themselves with an unhappy end to what had been a happy and rewarding career. To paraphrase a famous quote, if you don’t know where you are going, you might just get there.

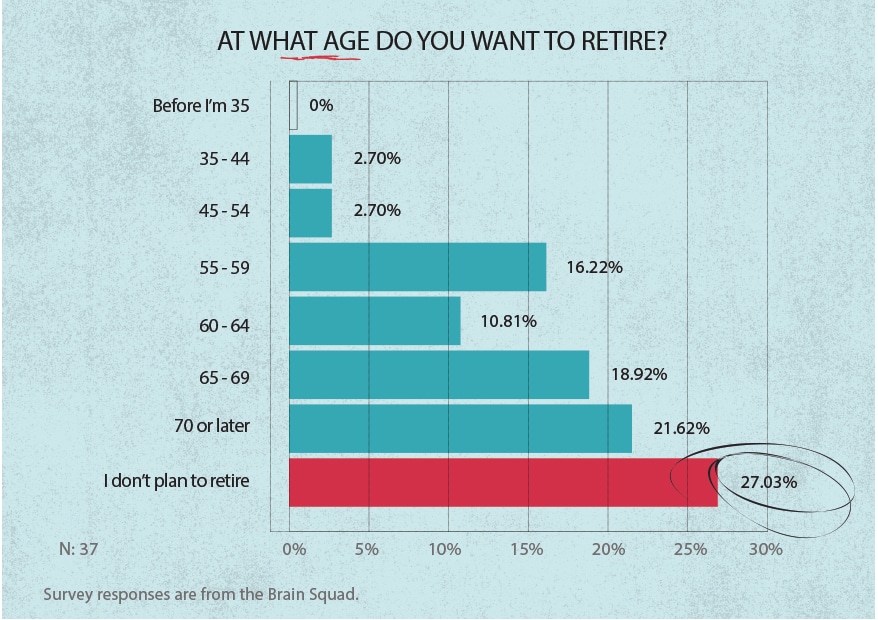

We asked the brain squad for their thoughts on retirement. here’s what they have to say:

-

- I have sold another company in this industry before. The company structure needs to be set up as if you were franchising. Every process and function needs to be clearly defined. Each job function needs to be clarified and [entered] into an established flow chart. — Keith Abrams, The Decoration Facility

- My sister and I are currently in the process of taking over the company, which was started by our grandparents and is now owned by our mother. I think open communication is key to this transition. — Ryan Toney, P&M Apparel

- We are working with a great coach, Mark Coudray, to help us. Our son has been in production for 10 years, and we just moved him into management. We want to retire in about six years. — Maude Swearingen, Fully Promoted Arbutus

- We’re all under 50 here, and about half of our staff is under 30, so no plans quite yet. — Ian Graham, Feels So Good

- We’re divvying up our shares amongst key people in the organization. — Eric Solomon, Night Owls

- Expanding the production management team to minimize the need for input from the “owner.” — Michael McCall, Chattanooga Labeling Systems

- I’m 24 years into this business and I have been thinking about what my succession plan will be. It’s not an easy question to answer. Typically, the amazing people who work in a business, whom the founder put years of effort into training and teaching to lead, can’t afford to buy the business or don’t want to. An employee is rarely an entrepreneur. So maybe they can run it and the founder stays the owner in absentia. But without someone innovative and motivated to take risks with new ideas and technologies, I fear a business will just slowly decline and become irrelevant – a great big asset slowly degrading until it gets shut down, worthless.

Of course, there is the option of pay as you go, where an employee buys and pays the founder out of future profits. But if that’s the case, why not keep it and collect the profits anyway, because, what if they buy it, mess it up, and there are no future profits? I’ve looked into ESOPs, where the employees slowly become shareholders, but I’m not sure that structure works well in a screen printing shop. And, again, that would be pay as you go, and pay as you go seems so risky to me.

So that leaves someone outside taking over with a new leadership structure and a big, one-time paycheck for the founder. [The buyer in this case] would be someone like a competitor or a customer. If you go that route, the whole culture and structure of the shop will change. Employees will likely move on. It won’t be what it was. But does that matter? Maybe it will be better under the new owner? You never know. The biggest issue with this option is finding that person who has money they’re itching to spend.

Exiting a business can be a road with 10 options where none of them seem like a slam dunk and so you just keep doing what you’ve always done: run the business yourself. My advice: If it’s time to go, set a deadline, talk to an accountant and a tax lawyer to make sure your business structure is best set up for a low-tax sale, and then start talking about it. Move forward. Kick some tires. Make some asks. Buy a few people lunch and put the word out there. Something will come along. Clarity will eventually arrive. And when it does, don’t hesitate. — Matthew Pierrot, Get Bold

- The elephant in the room is our business as a product decorator will not be the same five years from now as it is today. Adaptability will be the key capability that is required to survive and be profitable. That, and a fierce drive to be successful. I find that the current generation of workers/employees/business buyers has a very different set of expectations. For us – as business builders – no amount of time and sacrifice was too much. Today, it almost seems that any amount of sacrifice is unacceptable. — Larry Mays, Mays Marketing Group

-

We’re divvying up our shares amongst key people in the organization. — Eric Solomon, Night Owls

- For 13 years, my business partner and I have worked onsite, open-to-close shifts, including Saturdays. As the company grows, the responsibilities and workload have increased (high-class problem), but we are now realizing the crossroads. We’re in the middle of focusing and refining our daily procedures so we can hire and train employees to help take on some or all of these responsibilities. This has been a more difficult task than expected considering we are the ones who have created/invented the way we operate, and all the while we are buried with the day-to-day workload. Excuses aside, running a small business takes every second of every day, but with this new focus/direction I know we can free up some time and still run a successful business. — Jason Feather, Aka

- We are positioning ourselves for a sale. — Shawn LaFave, North Georgia Promotions

- We are actively in this process. This is our 50th year, and the plan is to step out of the day-to-day in the next 36 months. As part of this process, we are seriously looking at the strategies that will be necessary to keep the company going into the future. What got us here is not going to be the same moving forward. — Mark Coudray, Coudray Growth Tech

- Once I’m gone, so is the company. — Charlie Taublieb, Taublieb Consulting

- We had a ringer take over. She was great: talented, smart, and ready to modernize workflow and systems. We transitioned over about a year, until she had gradually taken on quotes, ordering, scheduling, billing etc. I was doing Fritired (I had Fridays off, so every weekend was a long weekend!), then more days, then gone. Then she got pregnant, and once the baby was born, that was it. So, the job of manager passed to a guy who never had the longer training. It was sink or swim for a while. It seems ok now, but he really doesn’t enjoy parts of the job. You can plan all you want. Shit happens; someone has to deal with it. It comes down to attitude. People either step up or step back. — Andy MacDougall, MacDougall Screen Printing

- We are not good at this. When someone retires, it is often disjointed for a bit, as the retiree typically does a ton of work. — Shamus Barrett, 7 Corners Printing

- I have a grandson working his way up the ranks right now to hopefully take over in about five years. — Al Messier, Team Print

What’s the Brain Squad?

If you’re the owner or top manager of a screen-printing business, you’re invited to join the Screen Printing Brain Squad. Take one five-minute quiz a month, and you’ll be featured prominently in this magazine, and make your voice heard on key issues affecting screen-printing pros. Sign up here.

SPONSORED VIDEO

Let’s Talk About It

Creating a More Diverse and Inclusive Screen Printing Industry

LET’S TALK About It: Part 3 discusses how four screen printers have employed people with disabilities, why you should consider doing the same, the resources that are available, and more. Watch the live webinar, held August 16, moderated by Adrienne Palmer, editor-in-chief, Screen Printing magazine, with panelists Ali Banholzer, Amber Massey, Ryan Moor, and Jed Seifert. The multi-part series is hosted exclusively by ROQ.US and U.N.I.T.E Together. Let’s Talk About It: Part 1 focused on Black, female screen printers and can be watched here; Part 2 focused on the LGBTQ+ community and can be watched here.

You may like

Advertisement

Atlantis Headwear Goes Solar for Sustainable Future

Comfort Colors Announces New Proprietary Dyeing Process Called “Pigment Pure”

10 Production Scheduling Secrets That Will Have Your Team Ready to Rock

Advertisement

Subscribe

Bulletins

Get the most important news and business ideas from Screen Printing magazine's news bulletin.

Advertisement

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns1 month ago

Columns1 month ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note4 weeks ago

Editor's Note4 weeks agoLivin’ the High Life

-

Marshall Atkinson4 weeks ago

Marshall Atkinson4 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Press Releases1 month ago

Press Releases1 month agoSports Inspired Clothing Market: The Influence of Sports on Fashion Forward Looks

-

Case Studies1 month ago

Case Studies1 month agoScreen Printing for Texture and Depth