How to Escape Price-Driven Sales Competition ... Forever

Avoid the consequences of competing using price as a sales strategy.

Published

4 months agoon

THE MOST COMMON THEME I hear on social media platforms, online videos, and conversations at trade shows and events is how to avoid price-shopping, tire-kicking, time-wasting customers. There’s a constant stream of posts and comments asking, “Where would your shop be on this?” Or, “Am I coming in too high on this?’’

Years ago, I would have chalked this up to sheer inexperience of not knowing the lay of the land. That’s not the case at all. The answers lay in a fundamental need to understand the role of price in the transaction.

Even experienced decorators fall into this trap because they’re afraid of losing business due to being priced too high. Printers seem to feel the buyer’s most important decision factor is the bottom-line price. In reality, it is only about eighth or ninth on a typical customer’s scale of importance.

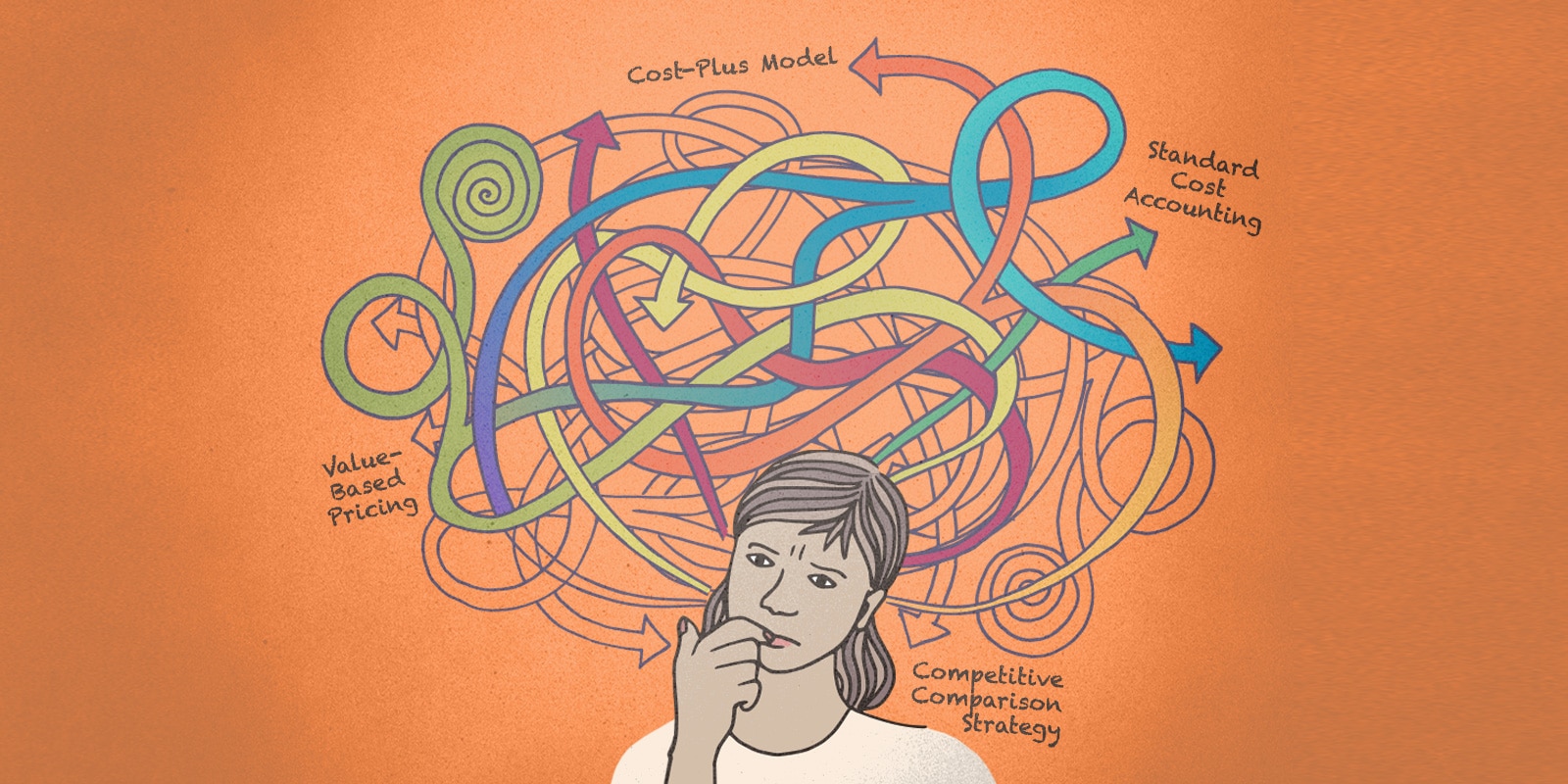

After many years of study, multiple factors come to light. Many different approaches or models for pricing exist. Each has a different value to the decorator and buyer. The goal is to have high value for both. This is the basis for win-win outcomes.

The most frequent concern among decorators in social media and events is how to deal with customers who focus on price, which can lead to a race to bottom-pricing strategies. Many decorators prioritize low pricing due to the fear of losing business, not realizing that price is not the top decision factor for most customers — actually it’s lower in priority.

This article will uncover the “Competitive Comparison Strategy,” where prices are set based on competitors’ rates and often leads to thin margins and customer churn as loyalty is lost to anyone offering lower prices. The “Cost-Plus Model” also discussed here is flawed because it assumes a level of operational efficiency rates rarely achieved, leading to not covering operating costs and no real profit. In future issues, this article series promises to explore “Value-Based Pricing” as a solution, which can significantly increase gross margins and net profits.

AdvertisementThe Wrong Way to Price

Let’s explore the two most common scenarios accounting for 95% of pricing decisions made by printers. We’ll start with the lowest value example, which is used by 80% of decorators today.

This approach is a strategy where prices are set based on what the decorator’s competition is charging. This is the “Competitive Comparison Strategy,” which usually is determined by copying price lists, secret shopper inquiries, comparison of bids, or quotes. This strategy is a recipe in frustration because it attracts and rewards bottom-feeding customers driven to buy at the lowest price.

The model operates on thin-to-negative Gross Margins, most typically sacrificing product quality and service to maintain the lowest price point. Companies relying on this model shoot for high sales volumes to achieve profitability. In the process, they minimize their Gross Margin (Sales – Cost of Goods). This results in the company taking longer to cover their operating costs to generate a Net Operating Profit.

This approach fuels commoditization as the buyer views the decorator as interchangeable with any other decorator. Price is the only differentiator and is the sole decision-making factor.

The situation gets worse when the printer pushes his advantage as offering “quality and service.” Every decorator says the same thing. I’ve never heard a printer say, “Our quality and service are just OK.” The buyer views these claims as expected and part of their definition of decorated apparel and goods as a commodity.

To make matters even more grave, there always will be new competitors making the same claims with a lower price. As long as the customer can find goods and services cheaper elsewhere, loyalty to the printer is destroyed. This leads to constant customer churn within the business and the need to replace lost clients before any new growth can be achieved.

AdvertisementIt’s certain you’ve had a new customer approach you and say, “You’re more expensive than our previous decorator.” When asked why they’re coming to you, they reply, “My old decorator went out of business.”

A Second Flawed Approach

A staggering 80% of small, decorating businesses use this pricing model because the owners don’t know any other way. They’re driven by the anxiety of not knowing how to sell or negotiate, and the need for sales to pay their bills. In the quest to find a better model, they’re drawn to the next worst model.

This approach is referred to as “The Cost-Plus Model.” It has its roots in traditional cost accounting and is based on recovering direct and indirect (overhead) costs of the business, plus adding some projected profit percentage.

The Standard Cost Accounting is taught in all accounting classes in school. This is why it’s so often recommended. It worked in the old analog industrial world when a factory only made “widgets” on a mass level. This approach sounds solid, except for a fundamental major flaw. It’s not what we do; it does not suffice for custom work.

All Cost-Plus pricing is based on some assumed level of efficiency in the business. This typically ranges between 80%-100%, which almost never happens. The basic operational efficiency in our industry ranges between 25%-35% for shops not tracking their data. This is based on my own personal experience measuring and tracking nearly 400 shops ranging in annual revenue of $500,000 to $100 million.

The worst example I personally witnessed was a large shop running 23 automatic presses on three shifts. The owners had never measured their efficiency and did not know what their costs were. They were super busy and were outsourcing nearly 100,000 units a week. After measuring, the overall performance hovered around 27%. This was due to long set-up and changeover times and extended approval delays on first samples on press. The size of each order usually was around 1,000 pieces.

AdvertisementLow efficiencies are typical when price-driven competitors engage in aggressive pricing strategies to fill orders and drive top-line sales revenue. It is compounded by the size of the order. The smaller the orders, the less time it takes to print, and the more time is spent in set-up and tear down. Thin margins mean production has to be super-efficient to have any chance of showing a profit.

Let’s do a little math (very little). For this example, we’ll use a single auto shop with a total overhead of $20,000 per month. This includes all costs: labor, rent, utilities, supplies, and so on. Let’s assume a 20-day month (4 weeks/month x 5 days/week). Without profit added, and producing product 100% of the time, the cost per day is: $20,000 month ÷ 20 days/month = $1,000/day.

You obviously will agree the press does not run all the time. We’ll use the typical accountant-advised 80% efficiency and see what that does to daily cost: $1,000/day ÷ 80%. The new cost per day is $1,225. This cost is paid for from the Gross Margin earned, not top-line sales.

There are a couple of very important points from here. For illustration, consider this example: First, the real observed efficiency is 25%-35%. Using 30% as a midpoint average, the Gross Margin needed per day to cover just the cost of operation is: $1,000/day ÷ 30% = $3,333/day.

Secondly, remember this does not include any projected profit, only cost recovery. To put this into even greater perspective, you cannot earn even one dime of profit until your Total Costs for the month have been paid for.

At this point forward, 100% of the Gross Margin becomes Net Operating Profit. This is what you’ve been working for. The point at which you recover Total Cost is referred to as the Break Even Point, or BEP.

Your assignment is to determine what your total monthly costs to operate are. Follow the above examples to calculate how much you need to earn every day, or even every hour, to hit your Break Even Point by Day 15 or Day 16 every month. The calculations may shock you.

Not to be discouraged, next month’s Part 2 of this series will introduce Value-Based Pricing where Gross Margins can be 15%-50% higher and double-digit Net Operating Profit become a predictable reality.

Mark A. Coudray is an industry pioneer with 47 years of technical expertise and leadership. He is a multiple Swormstedt Award winner in both technology and business, is a member of the Academy of Screen and Digital Printing Technology, and is a Certified StoryBrand Guide.

SPONSORED VIDEO

Let’s Talk About It

Creating a More Diverse and Inclusive Screen Printing Industry

LET’S TALK About It: Part 3 discusses how four screen printers have employed people with disabilities, why you should consider doing the same, the resources that are available, and more. Watch the live webinar, held August 16, moderated by Adrienne Palmer, editor-in-chief, Screen Printing magazine, with panelists Ali Banholzer, Amber Massey, Ryan Moor, and Jed Seifert. The multi-part series is hosted exclusively by ROQ.US and U.N.I.T.E Together. Let’s Talk About It: Part 1 focused on Black, female screen printers and can be watched here; Part 2 focused on the LGBTQ+ community and can be watched here.

You may like

Advertisement

Atlantis Headwear Goes Solar for Sustainable Future

Comfort Colors Announces New Proprietary Dyeing Process Called “Pigment Pure”

10 Production Scheduling Secrets That Will Have Your Team Ready to Rock

SUBSCRIBE

Bulletins

Get the most important news and business ideas from Screen Printing magazine's news bulletin.

Advertisement

Latest Feeds

Advertisement

Most Popular

-

Case Studies2 months ago

Case Studies2 months agoHigh-Density Inks Help Specialty Printing Take Center Stage

-

Art, Ad, or Alchemy2 months ago

Art, Ad, or Alchemy2 months agoF&I Printing Is Everywhere!

-

Andy MacDougall2 months ago

Andy MacDougall2 months agoFunctional and Industrial Printing is EVERYWHERE!

-

Columns4 weeks ago

Columns4 weeks ago8 Marketing Mistakes Not to Make When Promoting Your Screen Printing Services Online

-

Editor's Note3 weeks ago

Editor's Note3 weeks agoLivin’ the High Life

-

Marshall Atkinson3 weeks ago

Marshall Atkinson3 weeks agoHow to Create a Winning Culture in Your Screen-Printing Business

-

Thomas Trimingham2 months ago

Thomas Trimingham2 months ago“Magic” Marketing for Screen Printing Shops

-

Case Studies4 weeks ago

Case Studies4 weeks agoScreen Printing for Texture and Depth